Forexer Limited is pleased to announce our new 10-day deferred carry fee which is not swap. This carry cost is charged to traders who hold positions overnight. However, we are offering the first 10 days as a grace period. This means that day traders and short-term traders can enjoy free trading for the first 10 days.

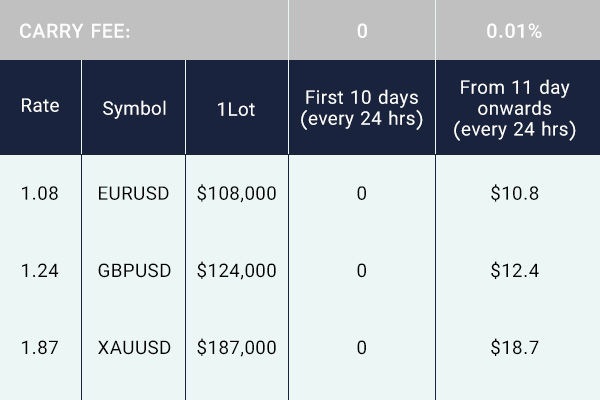

After the first 10 days, the carry fee will be charged on an opened position as follows:

- The fee will be 0.01% per $100,000 opened position.

- The carry fee will be charged upfront and withdrawn from the trading account every 24 hours.

- For hedge positions, each position will be considered a separate position and charged individually.

- We are implementing this fee to maintain the structure that other brokerages are following. We are not going to close any positions at the end of the year. Clients who intend to keep long-term positions can keep their positions for as long as they want.

.png)

Example

To facilitate your understanding and streamline the process, we have provided a detailed table as a visual aid. Within this table, you will find a comprehensive breakdown of the charges associated with three distinct symbols. We encourage you to thoroughly review this table to gain a clear insight into the specific cost of carry and their corresponding symbols.

Benefits of the 10-day deferred carry cost

If you are a day trader or short-term trader, take advantage of our 10-day carry fee and enjoy free trading for the first 10 days. Open an account today at Forexer Limited!

.png)